How To Get Personal Loan On Aadhar Card

How To Get Personal Loan On Aadhar Card

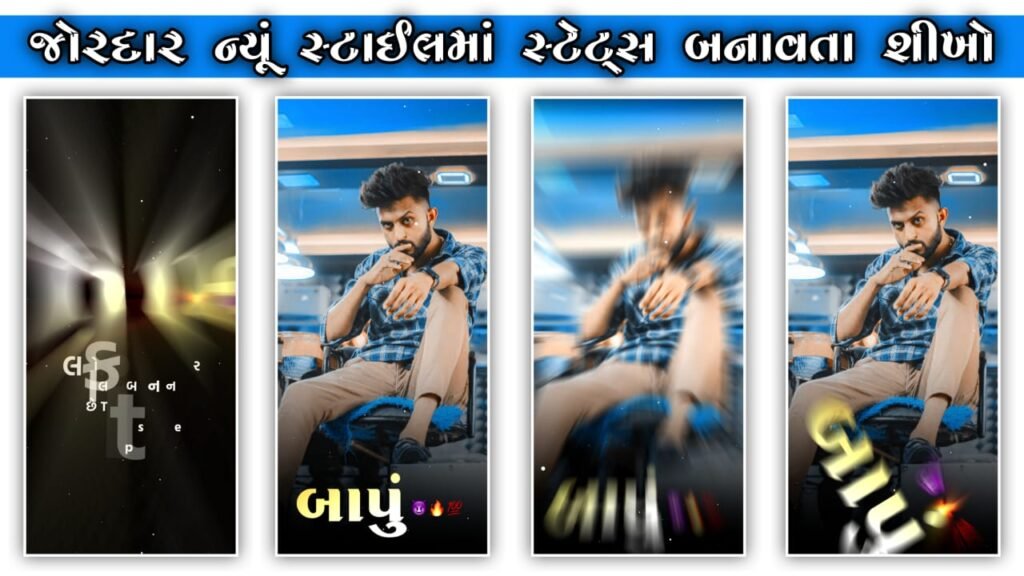

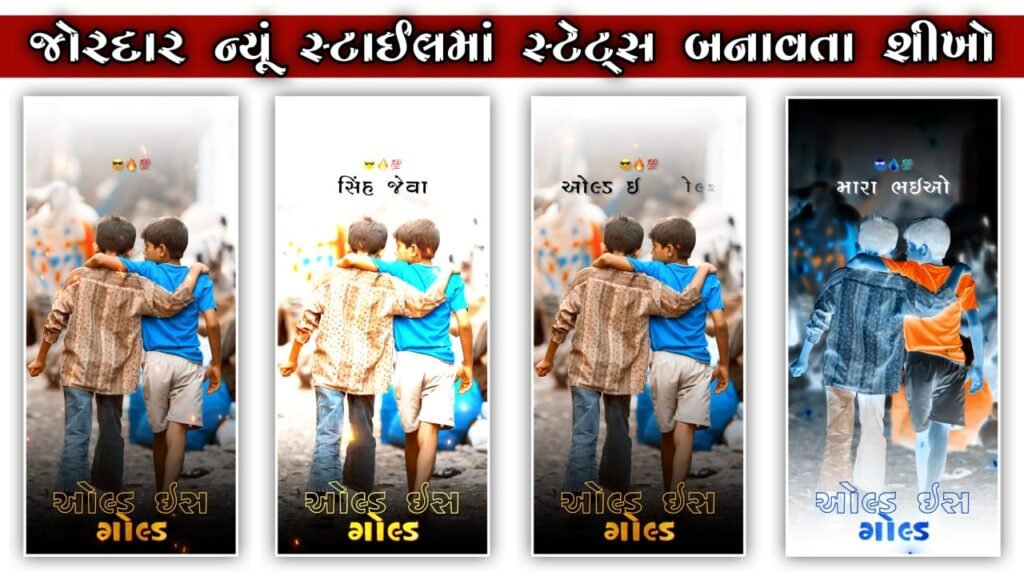

Standard Whatsapp DP – What is Aadhaar Loan or Personal Loan against Aadhaar Card? If you think that loan against Aadhaar card is a financial product similar to loan against credit card, then you are absolutely wrong. It is not possible to avail a loan using your UIDAI issued identity card, nor can you avail a loan with your Aadhaar card. Hence, phrases like ‘loan against aadhar card’, ‘personal loan against aadhar card’, and ‘aadhar card loan’ are confusing and can create a lot of confusion and this is a fact.

There is no financial product in the form of Loan Against Aadhaar Card; However, you can certainly use this UIDAI (Unique Identification Authority of India) ID to avail the loan along with other supporting documents mentioned by your potential lender.

When Aadhaar card is used as a paperless e-KYC document for availing a personal loan, it is commonly referred to as Aadhaar Card Loan. Aadhaar card fulfills your eligibility criteria for biometric verification, and hence, the overall process of getting personal loan approval becomes much simpler and faster.

How to take loan on Aadhaar card?

Earlier, you were required to submit a host of documents when you had to apply for a personal loan. But now, applying for a personal loan has become much easier with Aadhaar card and digitization. Your Aadhaar card is the single document that is KYC proof and is accepted by most banks and NBFCs as proof of identity, residence, citizenship and date of birth.

How to take loan from Aadhaar card

If you are wondering how to take aadhar card loan, all you need to do is fill an online personal loan application and provide your aadhar number to apply for a personal loan using your aadhar card. If your Aadhaar card is linked with your PAN and your bank account, then there is no need for you to upload additional documents for the same.

All you need to do is provide your address and income proof and allow the lender to conduct a background check on the basis of your Aadhaar card. Once you clear the eligibility and verification check, the personal loan will be approved, and the funds will be transferred to your account within a few days or maybe even earlier.

Note: As per a recent circular issued by RBI, Aadhaar card cannot be used as proof of address for financial accounts such as loans or deposits. This is why you will still need to provide a valid address proof such as electricity bill, passport, driving license, rent agreement, etc. while applying for a personal loan.

Mandatory documents for loan against Aadhaar card

- Aadhar card

- pan card

- Address Proof: Passport/Driving License/Ration Card/Electricity Bill/Rent Agreement

- Income Proof – Salary Slip, Income Tax Return and Bank Statement

- checks to your salary account

- duly filled application form

- passport size photographs

Eligibility Criteria for Applying Loan Against Aadhaar Card

- You must be a resident of India.

- Your age should be between 23 to 57 years.

- You must be working with a public/private company or a multinational company.

- Minimum salary requirements may vary depending on the lender and city of residence.

Benefits of applying for Personal Loan on Aadhaar Card

- This one document is considered as proof of citizenship, address, photo, age and identity.

- Aadhaar card helps in the online verification process (e-KYC) and facilitates faster disbursal of loans.

- Aadhaar card eases the documentation process for both consumers and financial institutions.

- This results in less time taken in loan processing, thus saving both time and effort.

- In some cases, you don’t even need to provide a copy of your Aadhaar card – just the 12-digit UID number is sufficient.

Questions To Ask

Can I get an instant personal loan with Aadhaar card? Yes, you can get a personal loan on Aadhaar card. Although personal loans are unsecured loan instruments that do not require you to provide any collateral, you are required to submit KYC documents to avail instant personal loan with Aadhaar card.

Can I get ₹10,000 loan against Aadhaar card online? To avail ₹10,000 personal loan against Aadhaar card online, the borrower needs a copy of his Aadhaar card

And fill all the necessary details in the application form and upload it online. In this, your Aadhaar card acts as a KYC document which helps the lender to verify all your details quickly. The loan amount is credited to your bank account after verification of documents like Aadhaar card and your annual income.

How to get Small Cash Loan on Aadhaar Card? For small amount cash loans, the borrower has to submit the application form and copy of Aadhaar card along with his address proof and identity proof. All these documents are used by the lender to verify the KYC process. You may also need to provide other documents as and when asked by the lender for small cash loan against Aadhaar card.

How to Apply for Personal Loan on Aadhaar Card Without Salary Slip? If you do not have salary slips and want to avail Personal Loan against Aadhaar Card, then you need to mandatorily upload or submit the last 6 months bank statement of your bank account along with the loan application form.